the cost

Investing in the Future of Austin Public Schools

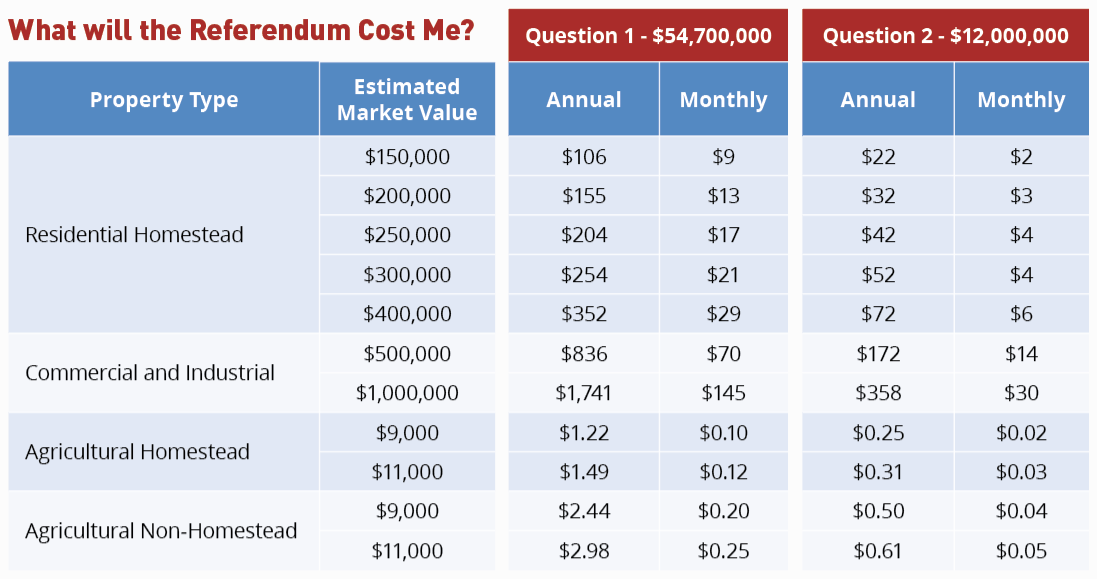

The district has worked carefully to ensure that the $66.7 million bond referendum addresses our biggest needs and reflects residents’ priorities. If approved by voters, these investments would be supported by a property tax increase starting in 2026.

Property Tax Refund

The state of Minnesota offers property tax refunds based on household income and total property taxes paid, which could lower the cost of the referendum on a $200,000 home to $4-5 per month. In our district, 8 in 10 households may qualify based on household income. For additional property tax refund information, click here.

Calculate your estimated tax impact

Your individual tax impact will depend on the value of the property you own. For a median home valued at $200,000, the monthly property tax increase would be $16 per month starting in 2026 ($13 for Question One and $3 for Question Two).

paid by the State of Minnesota

Tax Relief for Farmers

To reduce the impact of a bond referendum on owners of farmland, Minnesota’s Ag2School Tax Credit offers a 70% tax credit to all agricultural property except the house, garage, and one acre surrounding the agricultural homestead. This is not a tax deduction – it is an automatic dollar-for-dollar credit, with no application required.

Through the Ag2School tax credit, the State of Minnesota will pay about $8.6 million (or 13%) of the project, if approved by voters.